M Is Insured Under a Basic Hospital Surgical Expense Policy

Which of the following costs would a basic hospitalsurgical policy likely cover. A Health Reimbursement Arrangement MUST be established by the employer M is insured under a basic HospitalSurgical Expense policy.

Pdf Extent Of Inappropriate Prescription Of Artemisinin And Anti Malarial Injections To Febrile Outpatients A Cross Sectional Analytic Survey In The Greater Accra Region Ghana

The basic physicians expense policy pays for non-surgical physicians fees including office visits and non-surgical care by a physician while the insured is hospitalized.

. Jerry was seriously injured in a car accident and spent 50 days in the hospital at 250 per day before being discharged. Basically medical expense insurance can pay for all medical treatment and services always dependent upon the policy. 2837-C Must provide coverage for reconstruction of both breasts to produce symmetrical appearance.

C loss of income resulting from sickness. Extended medical stays can be extremely expensive. It specifies specific amounts available for certain surgical procedures.

F If the group insurance policy insures the employee or member for basic hospital andor surgical expense insurance as well as major medical expense insurance then at the option of the insurer the benefits outlined in subsections 1 and 2 above may be provided under one policy or certificate. What amount of the hospital stay is Jerry responsible for. He is insured under a basic hospital expense indemnity policy which pays a hospital benefit of 250 per day for up to 45 days.

Determined by terms of the policy Which of these is NOT a characteristic of a Health Reimbursement Arrangement HRA. Claim payment is equal to physicians actual charges Claim payment is negotiated between physician and patient Determined by the schedule of benefits from the hospital Determined by the terms of the policy. Coverage is provided for daily hospital room and board miscellaneous hospital services hospital out- patient services surgical services.

Hospital confinement indemnity insurance provides coverage on other than an expense-incurred basis while the covered. Hospital expense insurance is insurance coverage that protects policyholders against losses associated with being treated in a hospital for a medical issue. Basic Hospital and Surgical policy benefits are lower than the actual expenses incurred An individual has a Major Medical policy with a 5000 deductible and an 8020 Coinsurance clause.

Continue coverage but exclude the heart condition. Limits on priority liens 24-A MRSA. Types of Medical Expense Insurance There are typically two types of policies.

Regular medical insurance contracts indemnify the insured for expenses such as physicians home or office visits medicines and other medical expenses. Medical expense insurance is commonly purchased to supplement a regular health insurance policy. Claim payment is equal to physicians actual charges.

Basic Medical and Major Medical Expense. Two claims were paid in September 2013 each incurring medical expenses in excess of the deductible. A good health insurance policy would cover surgical expenses.

Under basic surgical expense policies the surgeons services are covered and it doesnt matter if the surgery was performed in or out of the hospital. Types of policies Surgical expense insurance covers the surgeons charge for given operations or medical procedures usually up to a maximum for each type of operation. What determines the claim M is eligible for.

Basic medical-surgical insurance provides coverage for in-hospital or surgical health services rendered by a physician or other covered health care provider c Hospital confinement indemnity insurance. Advertisement Insuranceopedia Explains Surgical Expense Insurance. Q is hospitalized for 3 days and receives a bill for 10100.

2836 No policy for health insurance shall provide for priority over the insured of payment for any hospital nursing medical or surgical services Coverage for breast cancer treatment 24-A MRSA. D surgical fees. Some people buy this type of insurance rather than.

Included in this coverage are the anesthesiologist and any postoperative care. M is insured under a basic HospitalSurgical Expense policy. Surgically removing a facial birthmark.

What determines the claim M is eligible for. Basic Medical Expense policies offer coverage for standard hospital surgical and physician expenses. B hospital room and board.

It works to insure certain types of hospital visitsstays surgery for specific types of procedures and common physician fees. 132 Basic Medical Expense Plans Medical expense insurance pays benefits for nonsurgical doctors fees commonly rendered in a hospital and sometimes pays for home and office calls as well. Comprehensive medical expense insurance covers room and board surgical fees and hospital miscellaneous expenses up to a dollar limit.

3 Comprehensive Medical Expense Benefits. A physician performs surgery on M. How much will the INSURED have to pay if a total of 15000 in covered medical expenses are incurred.

A HospitalSurgical Expense policy was purchased for a family of four in March of 2013. Claim payment is negotiated between physician and patient. Basic Hospital and Medical Surgical Expense Coverage means policies designed to provide coverage for hospital and medical surgical expenses only incurred as a result of a covered accident or sickness.

A physician performs surgery on M. A hospital miscellaneous expenses. The policy was issued with a 500 deductible and a limit of four deductibles per calendar year.

A physician performs surgery on M. M is insured under a basic HospitalSurgical Expense policy. These policies usually pay on an indemnity basis scheduled amount.

Surgical expense insurance is a type of insurance policy that helps cover medical fees involving operations. Under the Surgical Schedule method every surgical procedure is assigned a dollar amount by the insurer. 5000 20 of the remaining bill 7000.

Which of the following health insurance coverages is best suited for meeting the expenses of catastrophic illness. Comprehensive medical expense insurance covers all of the following EXCEPT. Other medical expenses may be included in these basic policies or as options added to the policy.

Two additional claims were filed in 2014 each in excess of the. What determines the claim M is eligible for.

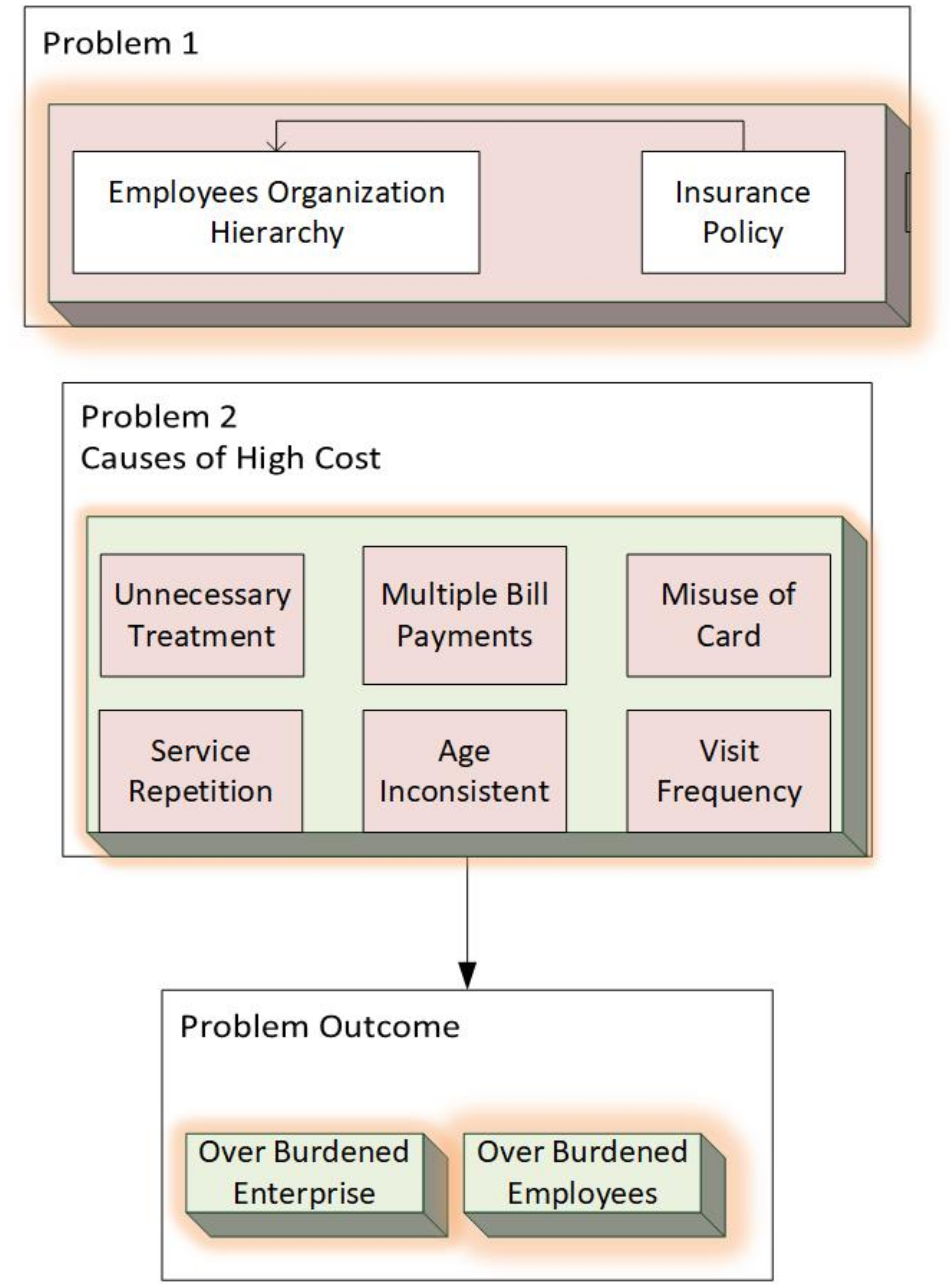

Applied Sciences Free Full Text Need Based And Optimized Health Insurance Package Using Clustering Algorithm Html

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

No comments for "M Is Insured Under a Basic Hospital Surgical Expense Policy"

Post a Comment